MID-SIZED MANUFACTURING ITALIAN COMPANIES

This article refers to our previous publication, https://www.knetproject.com/should-we-be-worried-mid-sized-italian-companies/(July 8, 2021). It shows an in-depth analysis of D-grade mid-sized manufacturing companies, meaning companies who may become potentially insolvent. https://worldwidescience.org/topicpages/m/medium-size+manufacturing+firms.html

This analysis shows that these companies are not only getting weaker in terms of credit score.

In order to repay financial debt, even when sales are increasing, the companies decreasing in their cash flow to the firm

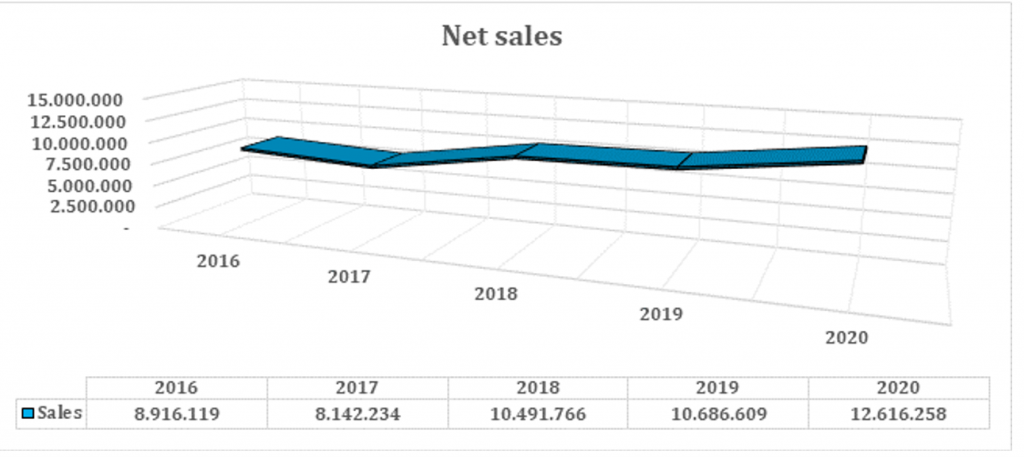

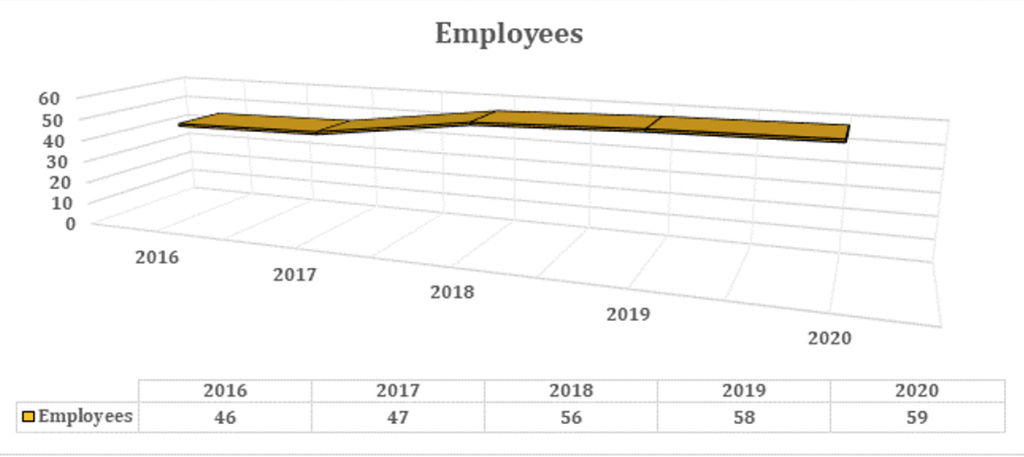

The following graphs are focused on a panel of D-grade mid-sized manufacturing firms.

They show that the median company size in terms of net sales and number of employees is increasing.

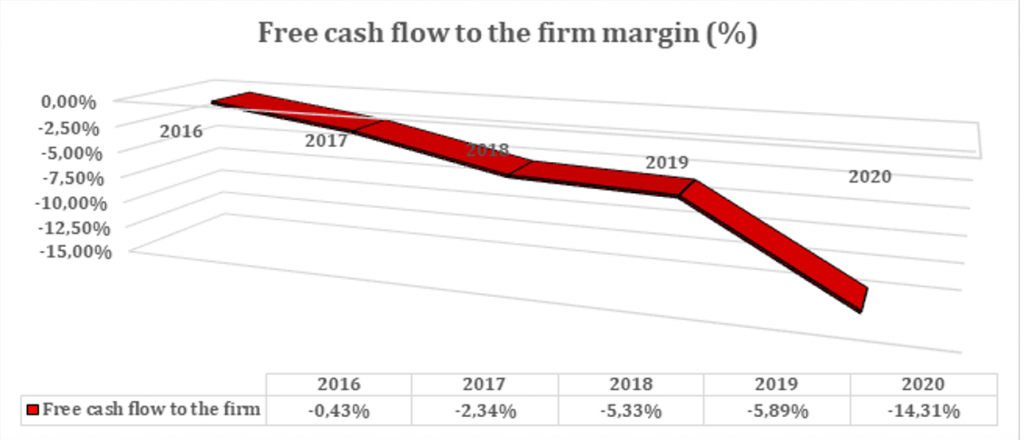

Additionally, the graph below shows:

in spite of increasing revenues, the selected panel’s median free cash flow to the firm margin is facing a significant decrease.

Therefore even if sales have been increasing, companies in trouble have more problems in terms of cash generation compared to the past.

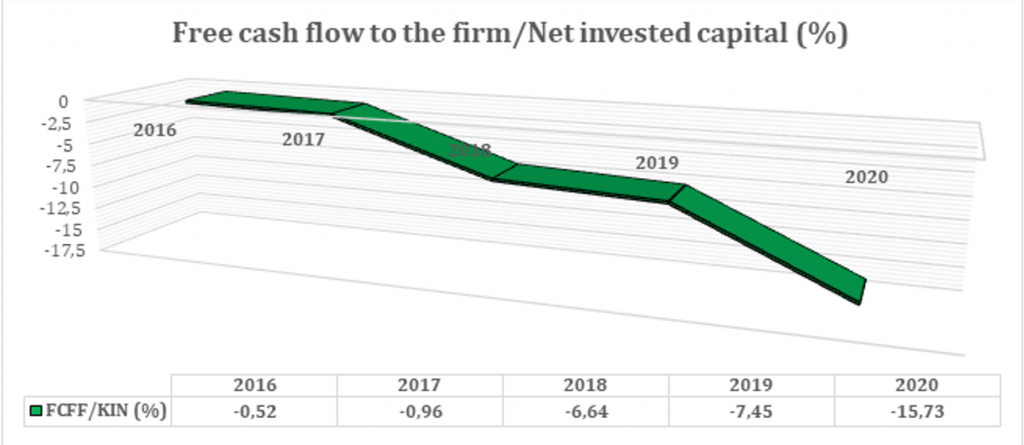

Last but not least, the following graph shows that the ratio between free cash flow to the firm and net invested capital is getting lower year after year.

In conclusion, after analyzing the median of some of the most relevant financial ratios within the selected panel of D-grade companies, we have revealed that:

- companies in trouble are slowly getting larger;

- the absorption of free cash flow to the firm is constantly getting higher;

- the ratio between free cash flow to the firm and net invested capital is decreasing

The causes of such results are:

- mismanagement when leading bigger firms

- poor cash management and bad cash conservation policies (when needed)